The world’s economy had been humming along at a relatively even keel until the COVID-19 pandemic started to take a toll, making people wonder, “How can we prepare for a financial crisis?” In March 2020, hundreds of large and thousands of small businesses across the United States were ordered to shutter their doors or had to close due to a lack of traffic as people try to socially distance themselves and lower their risk of infection with the virus. As a result, many people are now out of a job, and the economy is facing a recession or even a depression. So, how do we prepare for the unknown ahead?

Crisis is Inevitable

The phrase “relatively even keel” begs refinement. Over the past several years, states, like people, have been turning increasingly to credit. Currently, according to some estimates, 40 percent of states can’t afford to pay their debts. The federal government is in debt “up to its neck” as well. A visit to the website US Debt Clock is likely to leave people reeling. The site accurately shows the national debt rising in real time. Currently it is more than $200,000 per taxpayer.

Those taxpayers aren’t on solid financial ground either. Most don’t have adequate emergency funds to take them through a week of crisis, let alone a year, or even a month. We, like the state and federal government, are a nation enraptured with credit. We come through times such as the Subprime Mortgage Crisis (when banks offered too much credit to people with too-little capital and the economy foundered) and seem to lose our memory of the problem. The point is that many Americans have been sailing along with little thought to what could happen in a real financial crisis. Then the Covid-19 struck, and the bottom fell out. Today, with rising unemployment, the reemergence of food lines such as we saw in the Great Depression and division among political parties that makes governmental responses molasses-slow, Americans are struggling financially. There are, however, ways to prepare for financial crisis and to manage during crisis times.

Avoid Panicking

Panicking is a surefire way for the national and worldwide economy to falter. Instead of panicking, plan. Although planning can be difficult when the world is changing by the minute, having a general plan is a wise move. Individuals can make plans, such as making a list of places that are hiring or unsubscribing to services they can do without in order to save money. Some things that a panicked person might do, and which are a bad idea, include liquidating all investments, withdrawing large sums of cash from the bank or going to the local stores and hoarding the limited supplies of food that are available.

Panic is the reaction of someone who is unprepared to face a problem. It is defined as a sudden fear that may, or may not have a cause, and results in irrational behavior. Panic is lethal because it spreads, just like a virus. Future generations will shake their heads in wonder at their predecessors who struggled with overladen shopping carts of hoarded toilet paper yet spent nearly a million dollars a minute in online Christmas shopping. We, who are living through the current crisis, will shake our heads at the mounting bills and our shrinking resources. We will breathe an uncertain sigh of relief with suspended mortgage and student debt payments and postponed credit card bills. Those remedies are temporary, however, and the “piper” will eventually have to be paid. Here are some things we can do to get ourselves on more stable financial ground whether we are a young person just starting out or an older American trying to salvage our savings and retirement.

Support Small Businesses

On an individual basis, a person can make a budget, cut out all unnecessary expenses and eat lower-cost, basic foods. When making these changes, individuals should try to support local small businesses as much as possible. For example, a person could shop for their groceries at a family-owned market or farmer’s market instead of a national chain grocery store. These enterprises keep the money within the community. They also provide many job opportunities. Individuals could also call their legislators and encourage them to make small business loans available.

Think Outside of the Box

Both individual average Americans and subject matter experts will need to think outside of the box in order to prepare for the impending financial crisis. Individuals who have been furloughed from their jobs at restaurants, childcare centers, or stores might apply for jobs at grocery stores or personal shopping and delivery services, which are hiring at locations across the United States. Individuals could contact their creditors in order to request a grace period on bills. Lawmakers could work on legislation to temporarily suspend mortgage payments and student loan payments.

Listen to the Experts

According to the New York Times, Americans should focus on the quality information provided by subject experts. Instead of listening to the rumors about COVID-19 cures and risks shared by people on social media, individuals could instead turn to the Centers for Disease Control and Prevention or their state or local health department. Instead of listening to a panicked relative about finances, individuals could read about what the Federal Reserve, Treasury Department, and Small Business Association are doing in regards to sound economic decisions and recommendations.

This is a time of stress for most, maybe even all people. In addition to planning for the short-term financial future and long-term financial future, people also need to take care of themselves and their loved ones. Knowing the answer to, “How can we prepare for a financial crisis?” could help a person avoid depression, anxiety and stress over things they cannot control.

General to Specific

Those suggestions are common-sense and apply to everyone. The way we prepare for financial crisis is not a “one-size-fits-all” proposition, however. So, how is the preparation a young person might make different that what a person at pre-retirement or retirement age should do? How is individual preparation different that what a business needs to do to stay alive in the current, and in a future, crisis?

Individual Remedies

Avoiding panic is important, and the surest way to do that is to be prepared.

• One of the first measures to apply in a financial crisis, as noted by Investopedia, is to use checking accounts and savings before investment portfolios and certificates of deposit. That is because there is no penalty for early withdrawal on most of those accounts and you can access your funds at any time. Additionally, savings and checking are static amounts and are not dependent upon stock market ups and downs.

• Investopedia also suggests individuals don’t put money in stocks or retirement accounts until they have secured an emergency fund. While most Americans have less than a month of emergency financial resources, the suggestion is for triple that, or to put back six months of cash.

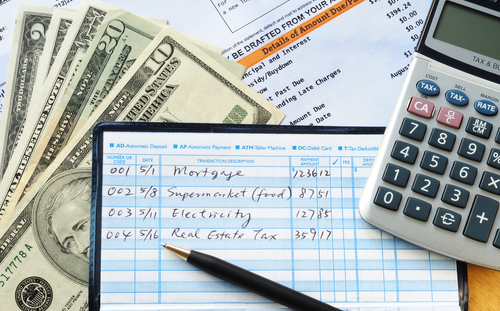

• Budgeting is important. The first step is to make a budget so that you can see where you stand financially, and understand how much money you really have available for each expenditure. A common formula is the 50-20-30 plan. Fifty percent of income is tagged for essentials like mortgage or rent, groceries, utilities and other necessary items. Twenty percent is put into some type of savings plan. The remaining thirty percent is spent on less essential or even non-essential things like eating out, new clothes and recreation. After making a budget, however, the challenge is sticking to it.

• Minimize monthly bills. Even though there is an allotment for non-essentials, that should be kept to a minimum, especially if there is a disruption in income. Additionally, people can shop around for checking accounts without fees, eliminate seldom-used telephone landlines and transfer credit card balances to new cards with less interest. Other money-saving hints include turning heat or air-conditioning down during the day when no one is home, looking for lower insurance rates and eliminating coverage you don’t really need.

• Manage bills. That, put simply, means to pay them on time and to stay current. Overdraft fees and interest charged on overdue accounts adds up quickly. A twenty-dollar check returned for insufficient funds can become a seventy-five dollar debt in a week with penalties. Besides that, those non-payments or late payments affect your credit rating, and your credit rating determines your ability to get low-interest loans in the future.

• Do maintenance on your vehicles, your home and even yourself. Well-running vehicles use less fuel and don’t break down as often, saving repair costs. A well-maintained home keeps you comfortable, holds or even increases its value and costs less in heating and cooling. A well-maintained “you” keeps you out of the hospital and can even affect your insurance rates.

• Pay down credit cards and bills. While this is not a way to survive a current crisis, it is a way to weather future ones. As soon as you get some breathing room in your finances, begin to overpay your minimums. A payment of an additional twenty-five dollars a month can add save you hundreds of dollars in interest over the life of the loan.

Additional Thoughts for the Young

• Young people just starting out will not have the resources that older people typically have. One of the things mentioned for that demography is to open a home equity line of credit or establish credit through a secured credit card. That can be a dangerous step, however, because the temptation is to over-extend. Still, having a good credit rating is important.

• Paying down student loans is another tactic. During the pandemic, and until January first, 2021, student loans and their interest are frozen. Beginning in the new year, however, they will resume. It is important to stay current, For many who maintain a good repayment record, the government may forgive loans after ten years.

• Prioritize payments. If you have very few resources, put them where they must be used. There are “must-pays,” “should-pays, and “I-wish-I-could-pays.” Rent or mortgage and utilities are in the first category. Some creditors may work with young people to adjust payment schedules for other things.

• Keep your resume updated and take online certification and/or degree courses to make yourself more employable if you lose your job.

Older Folks

• Older people usually have more assets than the very young. That means taking the opportunity to review them frequently, making certain that during a crisis you will have access to those resources.

• The older people who do not already have retirement accounts will be hurt the most during a crisis because their potential for building funds is limited due to fewer years remaining of employment. Older people who lose their jobs during a crisis usually are unemployed longer than younger counterparts, so their emergency or contingency fund should be greater. For them, surviving a financial crisis may mean transferring what funds they do have to secure accounts and employing money-saving techniques already mentioned for other groups.

Steps for Businesses

This one is harder, because there isn’t a lot a business can do once a crisis hits. For companies, it is all in the preparation.

• Build a survival team. Forbes Magazine says one of the best preparations for financial stability in a crisis is building a good team consisting of a financial and business advisor, an accountant and a payroll advisor. When a crisis strikes, they can be assembled and begin strategizing quickly.

• Look over your real estate options if the company owns property. Sometimes you can raise capital by selling off or leasing properties.

• Figure out how much money is necessary for the company to stay afloat each month. Try to put aside that much in cash reserves, at least enough for three months.

• Check over important documents. This is a step for before a crisis comes, and it applies to any sort of crisis. Make certain all signatures and permissions are in order. Make certain that in the event of the death or incapacitation of a business partner or important staff member, the people who need access to paperwork and accounts can get it quickly.

Above all, surviving a financial crisis involves making the best possible use of the resources you have at hand. That includes protecting savings, making the best use of the funds at hand by cutting corners where possible, making yourself as employable as you can, performing required maintenance on vehicles, appliances and homes, maintaining your own good health and, perhaps the most important, staying positive. With a little effort and some planning, you can do this.

Related Resources: